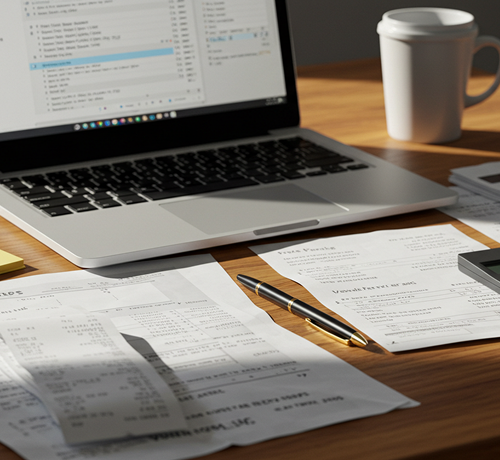

Get Expert Tax Support to Manage Your Finances Better

The USA has the most complex and complicated tax system.We specialize in federal and state tax preparation and assistance, corporate income tax return preparation, expatriate tax filing, and proactive tax planning. Our team of experienced tax professionals gives clear, practical solutions developed to optimize your tax planning to improve your cash flow, and ensure full compliance, allowing you to focus on your business growth and financial stability.