PCS Global is a trusted offshore accounting partner for US based Businesses, SME’s, Accounting firms and Consultants. Specializing in book-keeping, payroll, tax preparation, and financial reporting, we deliver accurate, GAAP-compliant solutions that enhance efficiency and reduce operational costs. Leveraging advanced cloud-based tools and a dedicated team, PCS Global ensures seamless integration with your existing workflows, acting as an extension of your in-house accounting and finance team.

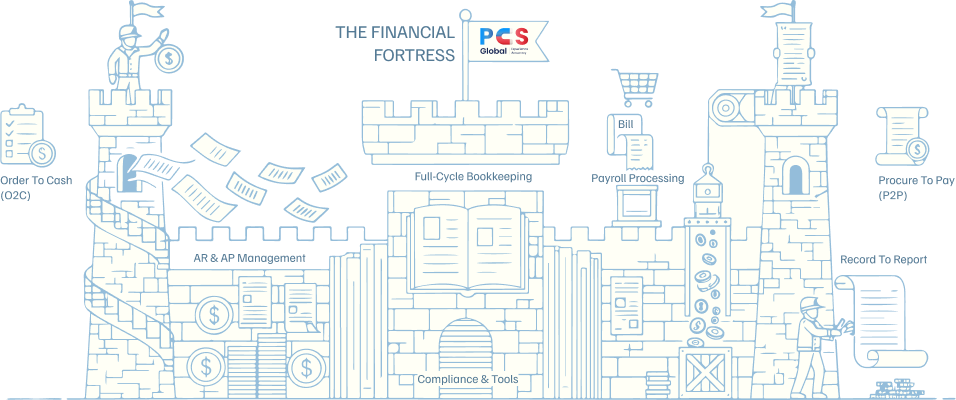

Complete Bookkeeping & Accounting Support

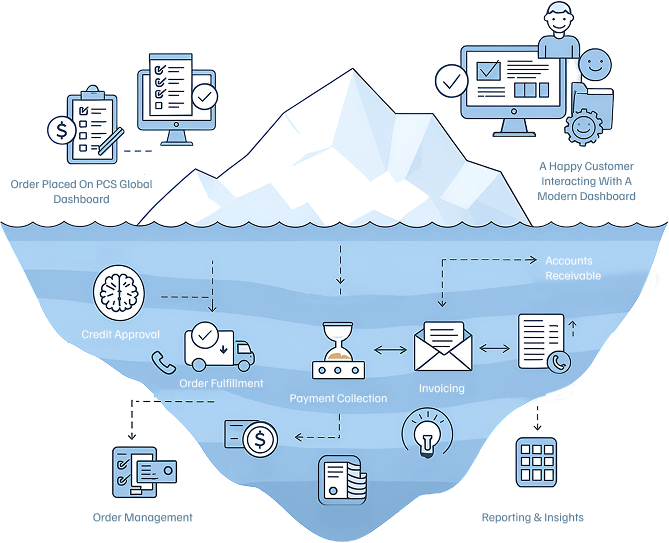

Order to Cash

Procure to Pay

AR & AP Management

Record to Report

Payroll Management & Processing

Sales Tax Compliance

Financial Analysis & Reporting

Tax Preparation

End-to-End Regulatory and Compliance Support

Our Technology Stack and Core Expertise

PCS Global delivers comprehensive book-keeping services meant to maintain your financial records accurately, organized, and up to date. Our book-keeping services incorporate accurate transaction recording, regular ledger management, and the creation of clear and understandable financial reports designed specifically for your business objectives. Whether you’re a small business or a continually growing business, we ensure that all transactions are recorded accurately and completed in compliance. With PCS Global bookkeeping for your financial accounting, you can focus on enhancing growth while ensuring that the financial numbers are being accurately maintained.

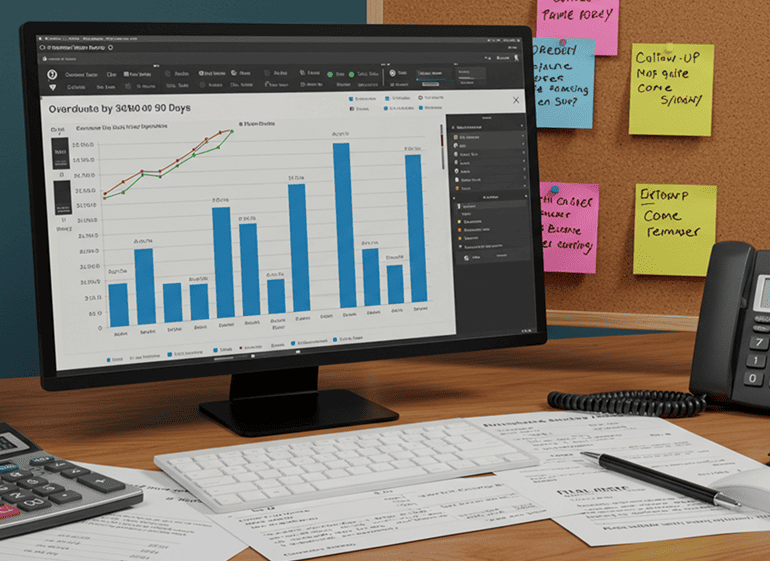

The size of the chart is made small in such a way that the complete process is seen on a single screen.

PCS handles procurement, vendor management, invoice verification & final payments.

Outsourcing your Accounts Payable to PCS Global simplifies the management of your payables cycle, strengthens contractor relationships, optimizes cash flow, and delivers clear, decision-ready reports for the top management, By ensuring accuracy, timeliness, and rigorous internal controls, we empower you to focus fully on strategic growth.

Effective AR management keeps cash flowing and customers satisfied. PCS Global automates invoicing, matches payments, and uses targeted reminders to reduce overdue balances, while enforcing credit checks to curb bad debt and for any backlog or compliance gaps, Our clean-up and reconciliation services quickly restore audit-ready financial clarity.

PCS Global lifts the full burden of your financial reporting cycle posting journal entries, maintaining the general ledger, handling treasury operations, managing month and year-end close, audit readiness, tax compliance, and fixed-asset accounting. Our services culminate in bespoke MIS and management reports designed not just for compliance, but for clarity transforming raw data into actionable insights tailored for Directors and CEOs to make better, faster strategic decisions. By outsourcing your accounting with PCS Global, you secure accurate records & accelerated, reliable.

PCS Global takes the guesswork out of sales tax compliance by first analysing your company’s footprint to pinpoint nexus obligations across states, reducing audit risk and identifying registration needs as your operations expand. We then handle every aspect of registration and reporting, from initial setup to ongoing submissions, so you maintain a strong rapport with tax authorities. Leveraging automation, we streamline complex multi-state filings, ensuring each jurisdiction’s deadlines and rates are met without manual headaches, keeping your business fully compliant wherever you operate.

PCS Global builds interactive financial dashboards using Power BI, QuickBooks, or similar tools to transform complex data into real-time metrics and actionable insights for decision-makers. At year-end, we compile and finalize your complete financials, post all necessary adjusting entries, and prepare statutory reports and ready-to-file statements and schedules, ensuring accuracy, compliance, and on-time filings.

PCS Global delivers end-to-end tax preparation services for businesses, individuals, and multi-member entities. We manage federal and state business returns covering corporate, partnership, and S-Corp filings with all required schedules and K-1s while ensuring accurate reporting, compliance, and minimizing audit risks. For individuals, including business owners and employees, we prepare Form 1040 returns with itemized deductions and complex income streams to optimize legal tax savings. Whatever your structure, PCS Global’s expertise keeps you compliant and confident come tax season.

At PCS Global, we take compliance seriously. Our services are designed to meet stringent U.S. regulatory frameworks across federal, state, and local levels. Whether you’re preparing for an IRS audit, meeting U.S. GAAP reporting standards, or managing state tax filings, we help ensure that your business remains fully compliant, without the stress.

PCS uses a wide array of modern tools to deliver efficient, cloud-powered accounting and business services: